Shop Pay vs Afterpay: What’s the Difference?

If you’re here, you might be puzzled about Shop Pay vs Afterpay. Questions like “What’s the difference between them?”, “Can you use both for the same purchase?”, or “Is Shop Pay the same as Shopify Payment?” arise in your mind.

Rest assured, as this blog post has cleared up all your confusion. What’s more, you’ll also learn some new insights not available in other existing posts.

Excited, huh? So let’s get started.

1. Overview of Shop Pay and Afterpay

1.1. Shop Pay

1.1.1. Definition

Shop Pay is Shopify’s checkout method that makes checking out on Shopify stores faster. It offers customers the option to securely save their payment and personal details, namely email address, shipping info, billing info, and credit card details. Thanks to it, customers don’t need to fill in all the information every time they purchase.

Remember, you need to activate Shop Pay so it’s usable on your Shopify storefront.

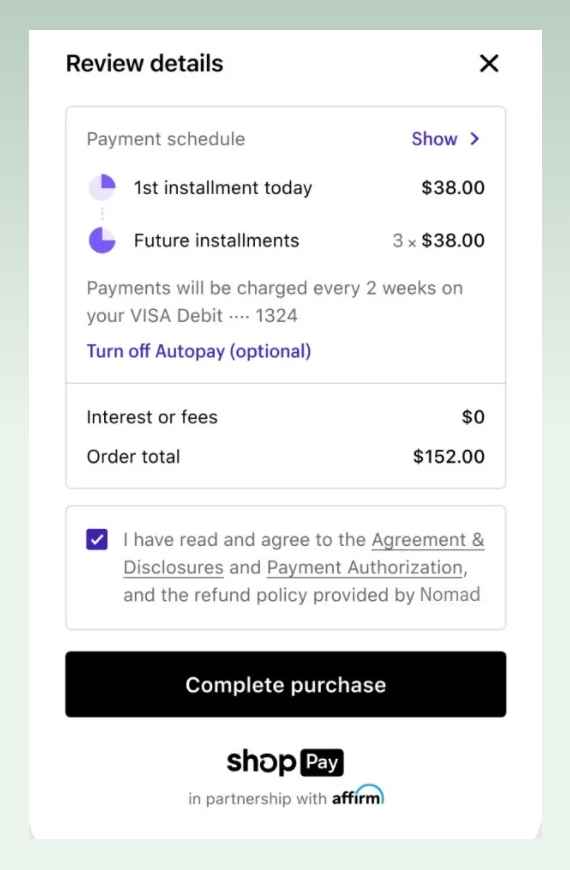

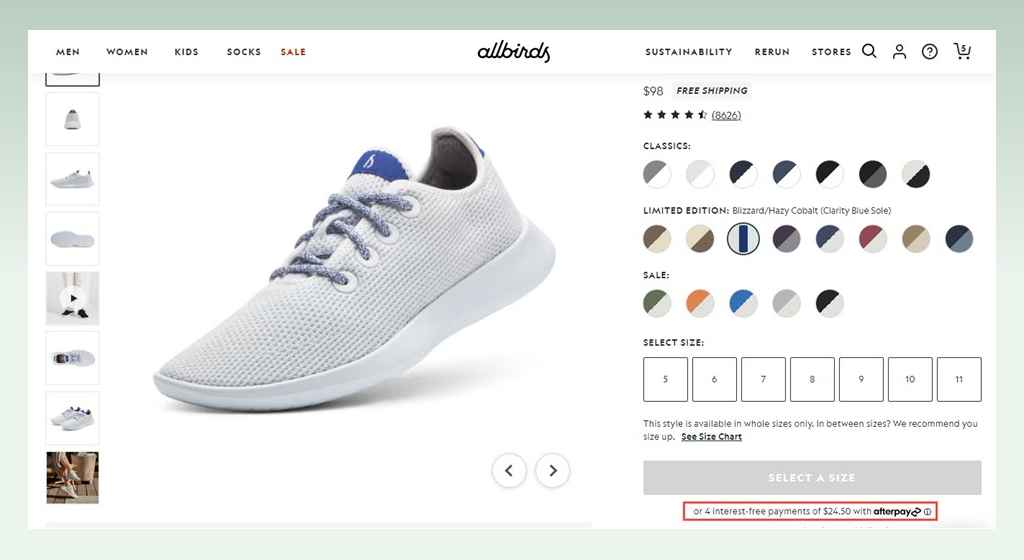

Using Shop Pay, store owners can give shoppers the “Split Pay” option (aka Shop Pay Installments). As its name suggests, the option enables customers to divide the total purchase cost into smaller payments, paid bi-weekly or monthly. Thanks to it, the initial cost of the item seems more affordable, encouraging shoppers to purchase expensive items. This helps boost the average order value for merchants.

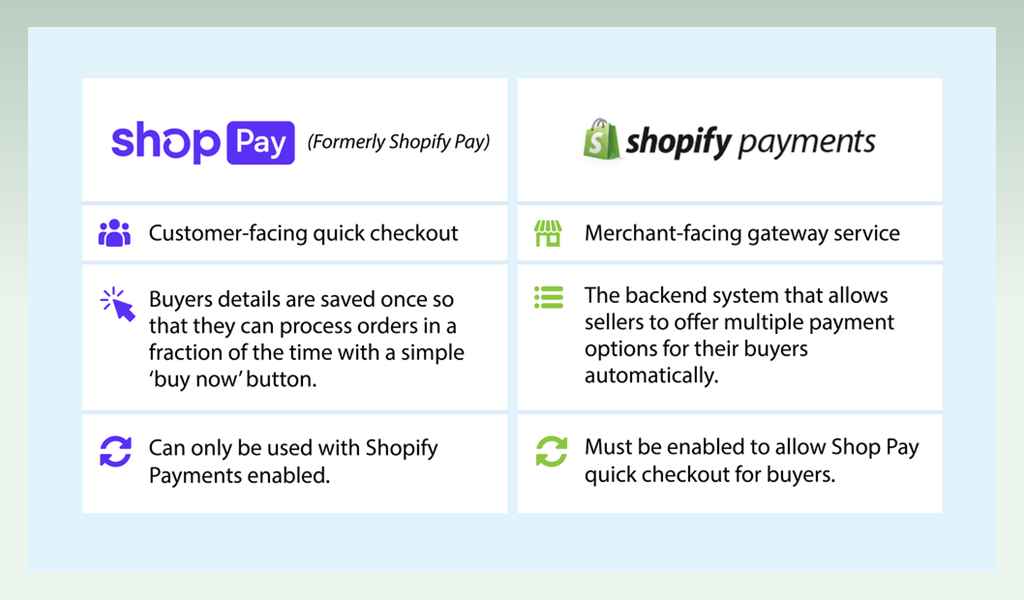

One thing to make clear for some of you: Is Shop Pay the same as Shopify Payment? While “Shop Pay” sounds like it’s short for “Shopify Payments” and even its former name, “Shopify Pay”, seems almost similar, they are not the same thing.

Shopify Payments is Shopify’s payment processor that helps merchants process transactions via their online store. This in-house payment processor accepts all major payment methods such as credit cards, debit cards, and digital wallets, letting customers choose the most convenient option. On the other hand, Shop Pay is an express checkout option that securely stores customer information for faster future checkout.

For easy reference, you can take a look at the table below. (Image source: a2xaccounting.com)

Read more: Shopify Payments vs Stripe Review (2024)

1.1.2. How does Shop Pay work?

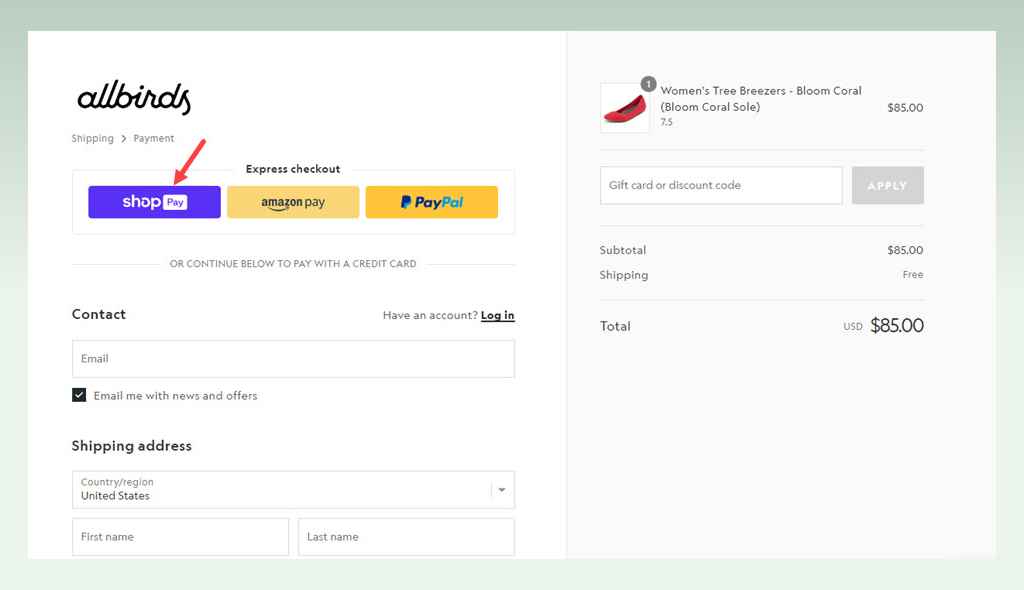

To use Shop Pay, customers can opt-in to it during checkout in two ways:

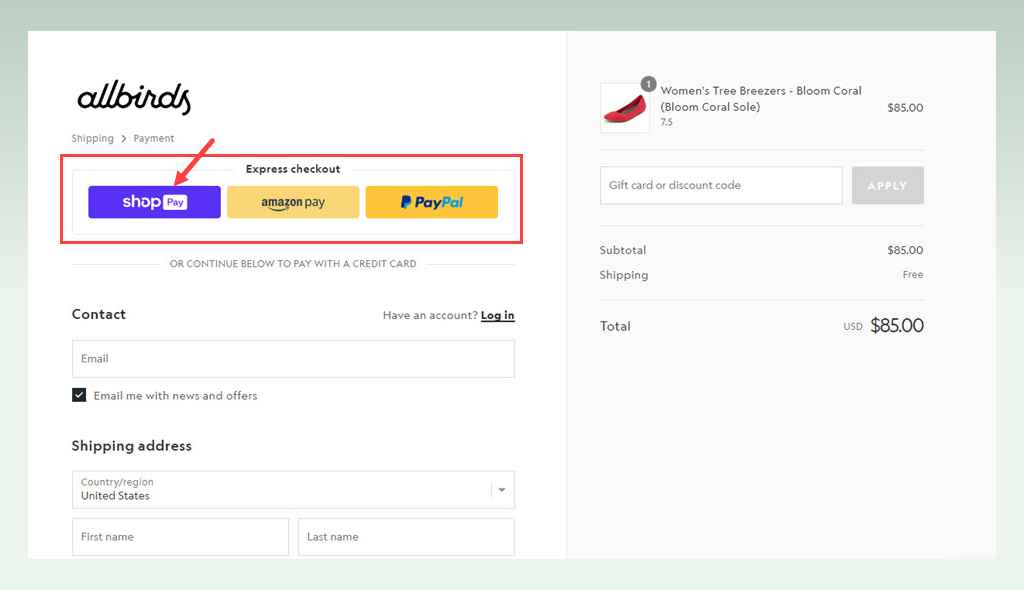

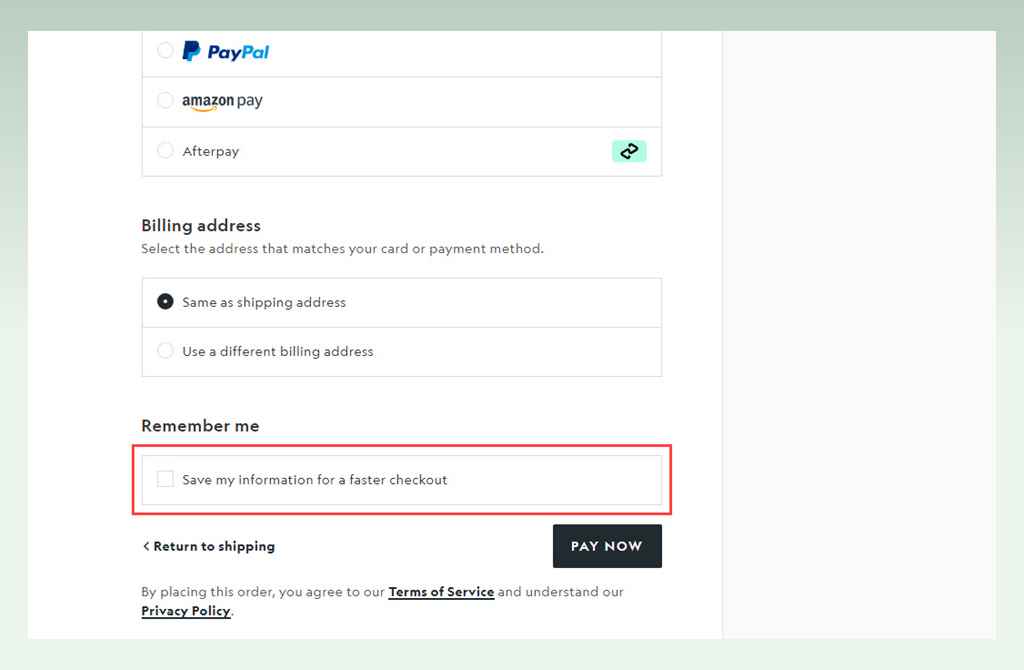

Option 1: Click on the Shop Pay button under “Express Checkout”.

Option 2: Check the box “Save my information for a faster checkout” in the Payment section (near the end of the checkout process). Once you enter your phone number and confirm, your Shop Pay account is created.

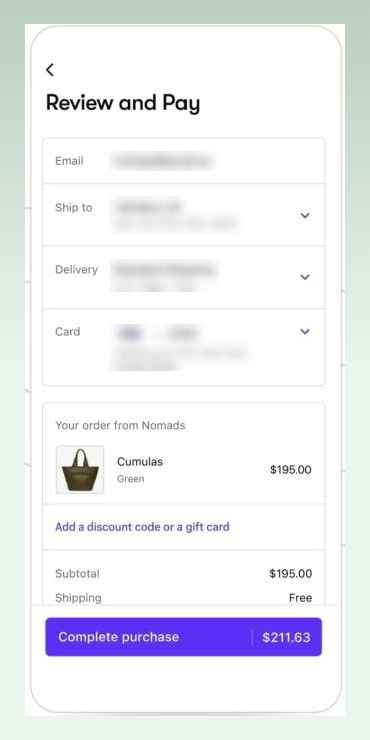

If the customer shops in your Shopify store on the same device next time, they’ll be directed to the order review page without having to fill in the checkout fields. But if they use a new device, they’ll need to verify themselves again.

One great thing about Shop Pay is that if a customer opts for Shop Pay on your store, they can use it on any other Shopify store with Shop Pay enabled, not just yours.

1.1.3. Key benefits of using Shop Pay

It enhances customer shopping experience and conversion

The main benefit of using Shop Pay is that it makes it easy for customers to check out quickly. Think about it for a moment. If regular customers have to fill in a lot of information every time they shop from your store, it can be frustrating, and they might even leave without buying.

But with Shop Pay, customers just need a few clicks to finish their purchase. This helps enhance the customer shopping experience and therefore conversions or sales. The convenience also encourages customers to come back to your store and shop again.

It’s safe

Shop Pay protects customer info using secure encryption. This makes sensitive details—such as card numbers, CVV codes, and expiration dates—unreadable and keeps them safe from unauthorized access. Once a customer places an order, as a merchant, you only receive necessary order details such as name and shipping address, but not the full credit card number.

What’s more, to use Shop Pay, shoppers have to enter a code sent to their mobile phone at checkout. This makes it tougher for hackers to access a Shop Pay transaction.

In a nutshell, Shop Pay does restrict sharing customer information with third parties, including store owners or websites using Shop Pay.

For these reasons, Shop Pay is a great choice for Shopify store owners seeking a secure accelerated checkout method.

1.2. Afterpay

1.2.1. What’s Afterpay?

Afterpay is a “buy now, pay later” payment option that enables shoppers to split their total purchase cost into four equal installments. With Afterpay, shoppers won’t have to pay extra fees or deal with credit checks.

This convenient pay-later option is great for those who desire to buy products or services, especially expensive ones, without needing to pay the entire amount upfront.

If you partner with Afterpay as a retailer, your store will be listed on their retailer page. This makes it easier for customers to find your website even when they’re browsing on Afterpay.

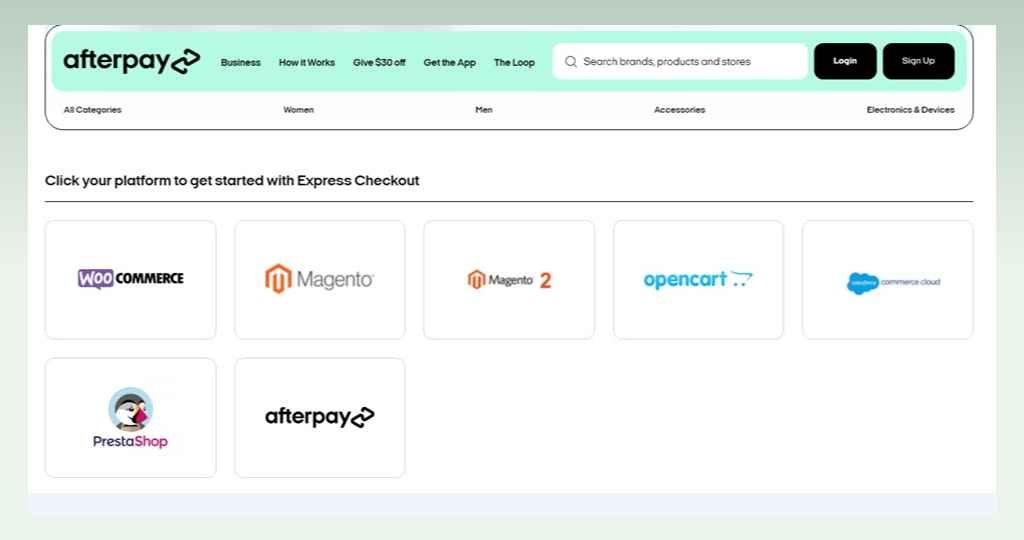

One interesting thing is, that Afterpay also has a quick checkout option like Shop Pay. However, the feature doesn’t support Shopify-based stores.

1.2.2. How does Afterpay work?

To use Afterpay, first-time shoppers sign up for an Afterpay account that will be instantly approved. Opted-in customers can simply sign in to purchase with Afterpay. They can shop in a store or on Afterpay’s app.

The total purchase cost will be split into four equal payments over 6 weeks. The shopper pays the first installment at the time of purchase, and Afterpay pays the merchant the full amount in 1-5 business days.

Afterpay deducts payments directly from their connected card on scheduled dates. Of course, the customer can make an earlier payment. However, if they don’t pay on time, late fees will incur.

1.2.3. Benefits of using Afterpay

It helps increase sales

Adding Afterpay to your Shopify store can boost sales. When customers find items they desire but can’t afford upfront, it often hinders purchases. With Afterpay, they can make four interest-free payments over 6 weeks, making it easier for them to buy, especially for pricier items.

It guarantees upfront payment

Allowing customers to pay after their purchase can have risks like late or missing payments. However, using Afterpay, store owners don’t need to worry because Afterpay covers the full cost and sends it to your store within a few days. For customers, they’ll make payments to Afterpay in installments over the next 6 weeks.

Want to experience your first online store?

No problem! Get started with Shopify free trial & $1 only for first month!

1.3. Our verdict

After getting to know Shop Pay and Afterpay, you likely have the answer about their difference. Yes, that’s right. Shop Pay and Afterpay are completely different types of products. They cater to different purposes.

Shop Pay PRIMARILY focuses on making the checkout process faster (a checkout option) while Afterpay gives customers a flexible, convenient pay-later option (a payment option).

Shop Pay and Afterpay are not exclusive to each other. They even can team up to deliver a convenient shopping experience for customers and ultimately boost sales and revenues. So it’s totally impossible to compare them or say which one is better than the other.

So is that all for now? Actually, no. There’s one more thing we want to clarify.

In essence, Shop Pay and Afterpay have different purposes. However, Shop Pay, alongside its focus on quick checkout, also offers Shop Pay Installments powered by Affirm, similar to the function “Buy Now Pay Later” of Afterpay.

Now, the question is: Which is better for post-payment? If merchants use Shop Pay with the Installment feature available, do they still need Afterpay? In reality, many websites have both Shop Pay and Afterpay.

If you’re wondering about the same questions, keep reading for the answers.

Read more: Shop Pay vs PayPal: Which is Suitable for Your Shopify Store

2. Shop Pay Installments vs Afterpay: Key Differences

Instead of reading a wall of text, let’s check out the side-by-side table for Shop Pay Installment and Afterpay. Based on it, we’ll get the answers to the earlier questions.

| Shop Pay Installments | Afterpay | |

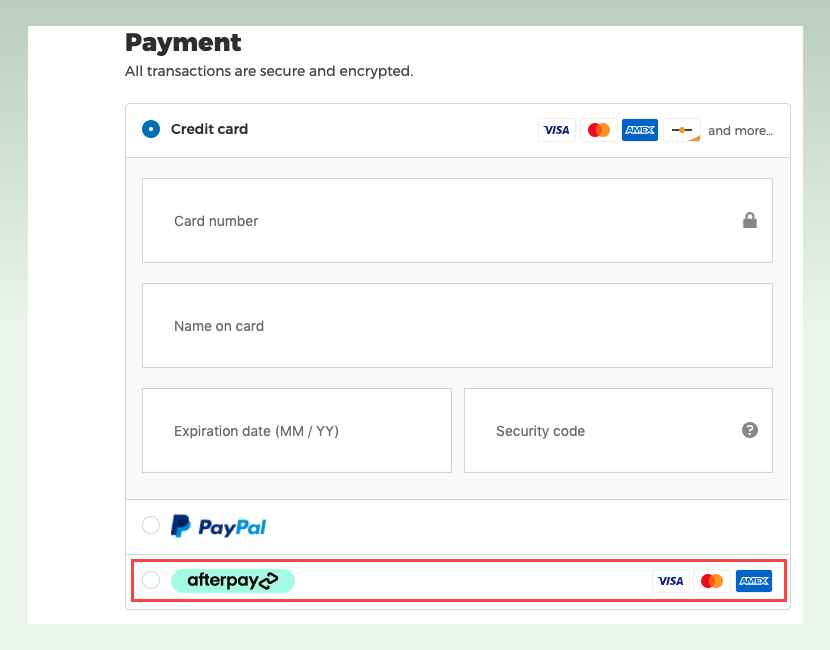

| Availability | – Only available for Shopify online store and in-store | – Available on a wide range of online stores based on different platforms, namely Shopify, WooCommerce, Wix, BigCommerce, Magento, Magento 2, Adyen, Ecwid, Squarespace, Prestashop, Salesforce Commerce Cloud) – Available for in-person retailers (i.g., Skechers, MAC Cosmetics, Levis, American Eagle, etc.) |

| Supported countries | US | – Biweekly plan: US, Canada, New Zealand, and UK – Monthly plan: US. (except Nevada, Hawaii, West Virginia, and New Mexico) |

| Supported currencies | USD | – Biweekly plan: USD, CAD, AUD, and NZD – Monthly plan: USD |

| Commission | 5.9% + $0.30 per transaction | 4-6% + $0.30 per transaction |

| When sellers get paid | 1-3 business days | 1-5 business days. Afterpay tries to reduce them as much as they can. |

| Security | PCI DSS Level 1 Note: PCI DSS Level 1 boosts the security of cardholder data and guarantees sensitive customer credit card info is safely handled and stored. | PCI DSS Level 1 |

| Installment period | – 4 bi-weekly, interest-free payments: applied for orders from $50 to $999.99 Note: For example, a $100 order could be divided into 4 payments of $25, payable every 2 weeks. – Monthly installments (paid in 3, 6, or 12 months) applied for orders from $150 to $20,000 +) Interest rate: 10%-36% APR | – 4 bi-weekly, interest-free payments – Monthly installments on orders over $400 (paid in 6, 12 months) +) Interest rate: 6.99%-35.99% APR |

| Spending limit | – Biweekly plan: $50- $999.99 – Monthly plan: $150-$20,000 | – Begins with a $600 limit, increasing over time. – The highest transaction limit is $1500. Note: The limit depends on factors like spending history and timely payments. |

| Eligibility requirements | – Must have a U.S. billing address – Have a Shop Pay account – Order amount: $50 to $20,000 | – Be 18 years or older – Have a valid bank payment card from eligible countries – Provide a valid email address and phone number for Afterpay account creation – Able to enter a legally binding contract |

| Transaction approval | – Approves instantly – Low transaction decline | – Approves instantly – Rarely declines transactions |

Shop Pay Installments is particularly ideal for US-based Shopify merchants selling in USD.

Afterpay is an ideal option if Shopify merchants want to tap into diverse markets.

- Shop Pay Installments is only available in Shopify stores, while Afterpay supports a variety of online stores on many different platforms. This does mean Afterpay has a much larger user base than Shop Pay Installments. Customers who are already familiar with Afterpay will find shopping in your store convenient and enjoyable if Afterpay is available in your store.

- Shop Pay Installments is for US-based merchants that sell in USD. Plus, customers must be US residents if they purchase physical products. On the other hand, Afterpay supports more countries and currencies. This helps merchants reach diverse markets compared to Shop Pay Installments.

Our verdict: Shop Pay Installments is particularly well-suited for Shopify merchants targeting the US market only, while Afterpay is for diverse markets and a broader customer base. Both charge no setup and subscription fees. So it makes sense that Shopify merchants often use both in their stores.

Read more: Top 15+ Shopify Alternatives That Are Best Kept Secret

3. To wrap up

After reading this article, we’re pretty sure you’ve had the answer to the question “What’s the difference between Shop Pay vs Afterpay?”.

Shop Pay and Afterpay are different types of products, yet they also share their core feature. Specifically, Shop Pay provides a pay-later option like Afterpay, and Afterpay has an express checkout similar to Shop Pay. However, these extras aren’t equally strong, so merchants like you can consider using both in your Shopify store.

And that’s it. Have any questions? Feel free to drop them in the comments below. Follow eComStart.io to get valuable insights and the latest news about eCommerce.

Want to experience your first online store?

No problem! Get started with Shopify free trial & $1 only for first month!