Shop Pay vs PayPal: Which One to Accept Payments Online?

If you want to improve your checkout page’s conversion rate, ensure your customers can select the payment options they want without the hassle. But which one should you choose between the 2 most popular Shopify payment options, Shop Pay vs PayPal?

Don’t worry if you don’t make up your mind yet. In this blog, we will walk you through a head-to-head comparison of Shop Pay vs PayPal regarding key factors– transaction fees, countries supported, ease of use, etc.

1. Shop Pay vs PayPal: All the differences summarized

Are you in a hurry? Let’s take a look at all the key differences between Shop Pay vs PayPal we’ve summarized for you:

| Key factors |  |  |

| Definition | Shop Pay is an express checkout solution that comes exclusively with Shopify Payments. | PayPal is one of the most popular payment gateways for online stores worldwide, including Shopify stores. |

| Number of users | Shop Pay is increasingly popular, with a user base of 60 million users | PayPal has a much larger user base: 435 million |

| Target audience | Shop Pay is only accessible for Shopify stores eligible for Shopify Payments. | PayPal can be used by any merchants worldwide to accept online payments. |

| Function (What’s it used for) | + Express checkoutInstallments + Shop Cash (a reward program for US-based customers) + Work with Shopify Markets to accept local currencies | + Accept online payment + Buy now, pay later + Support currency conversionAccept cryptocurrency |

| Transaction fee | Fees for processing online credit cards are exactly the same as when you use Shopify Payments, with no extra costs: 1. Basic: 2.9% + 30¢ 2. Shopify: 2.7% + 30¢ 3. Advanced Shopify: 2.5% + 30¢ 4. Shopify Plus: 2.15% + 30¢ | 2.99% of the transaction amount + $0.49 fixed fee |

| Ease of use (Installation) | It’s super easy to enable Shop Pay for your store as long as you’re eligible for Shopify Payments. | PayPal is easy to set up. But compared to Shop Pay, it takes a bit more effort. |

| Countries supported (Acceptance) | Shop Pay can only be activated with Shopify Payments – which is available in 23 countries only. | PayPal is available in over 200 countries– almost 10x the number of Shop Pay. |

| Currency | Shop Pay supports 13 currencies: AUD, EUR, CAD, USD, CZK, DKK, HKD, JPY, NZD, SGD, SEK, CHF, and GBP. | PayPal supports 25 currencies: AUD, BRL, CAD, CNY, CZK, DKK, EUR, HKD, HUF, ILS, JPY, MYR, MXN, NOK, NZD, PHP, PLN, GBP, RUB, SDG, SEK, CHF, TWD, THB, USD. |

| Payout schedule | Shop Pay takes around 2 to 5 days for the money to arrive at your bank account– which is a bit faster than PayPal | PayPal’s processing time is a bit longer than Shop Pay, at around 5 to 7 days. |

| Dispute resolution | 15 days for you and your customers to settle down. Afterward, Shop Pay takes 65-75 days to investigate the dispute. Chargeback fee: $15 | 20 days for both sides to sort things out. If an agreement isn’t met, PayPal will process the dispute within 75 days. Chargeback fee: $20 |

| Support | 24/7 support via live chat, email, phone call and social media. | PayPal support team is competent but they are not as prompt as Shop Pay. |

| Security | Shop Pay is PCI-compliant. This means you can securely accept credit cards from your customers. | PayPal is also PCI-compliant and highly secure for your customers too. |

2. A quick glance at Shop Pay vs PayPal

2.1. Shop Pay Overview

Shop Pay is an express checkout option that is offered exclusively for merchants who are eligible for Shopify Payments – Shopify’s in-house payment gateway.

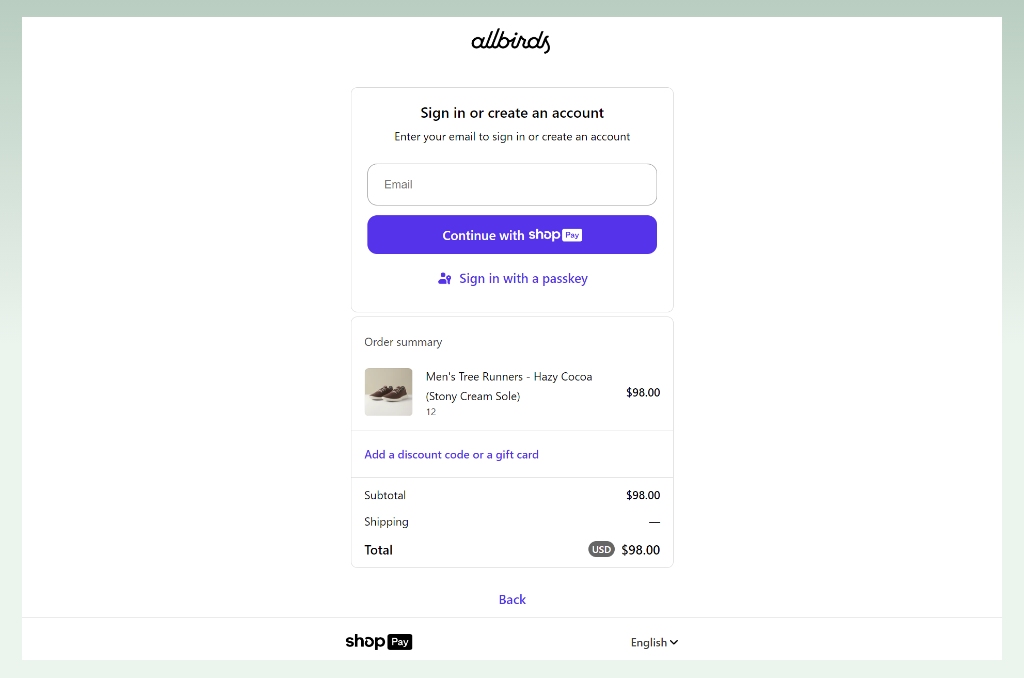

Basically, Shop Pay lets your customers save their checkout details like shipping and billing addresses, credit card information, and phone numbers. This way, when they buy something again, Shop Pay will automatically fill in those details without manual entry.

And if you’re selling in the US with US dollars as your currency, you can also let your customers buy now pay later with Shop Pay Installments or encourage them to buy more and save more with Shop Cash.

| 🤔 Is Shop Pay another name of Shopify Payments? No, they are not. Shopify Payments is Shopify’s own payment gateway, which includes many payment options. Shop Pay is a payment option (an accelerated checkout option, to be precise) belonging to the Shopfify Payments’ package. |

2.2. PayPal Overview

PayPal is a digital payment service that helps both sellers and buyers conduct safe transactions online. It’s especially popular for online shopping since it lets customers pay without having to give their credit card or bank details to the website they’re buying from.

PayPal distinguishes itself with its versatility, supporting a broad range of payment methods beyond traditional bank and credit card payments, including pay-later options, Venmo, and even cryptocurrencies in certain cases.

For those who use Shopify to sell products, PayPal is automatically offered as a payment method. When you create a Shopify store, you automatically get a PayPal Express Checkout account tied to the same email address you used to sign up.

However, before you can start accepting payments from your customers through PayPal, you need to go through a step to activate your PayPal account.

3. Shop Pay vs PayPal: A head-to-head comparison

3.1. Transaction fee

| ⚠️ DISCLAIMER: The Shop Pay and PayPal transaction fee information below is primarily in the US. They might vary from country to country and are subject to change. Therefore, you should use the information below for reference only. |

You won’t want to break the bank. Hence, Shop Pay vs PayPal cost would be the first factor we’ll discuss.

From our latest info, here are the common transaction fees that might occur when you accept payments with Shopify vs PayPal:

| Fee types | Shop Pay (via Shopify Payments) | PayPal |

| Online credit card processing fees | Basic: 2.9% + 30¢ Shopify: 2.7% + 30¢ Advanced Shopify: 2.5% + 30¢Shopify Plus: 2.15% + 30¢ | 2.9% + 30¢ per transaction in the US |

| In-person transactions | 2.7% per transaction (Basic Shopify Plan in the US) | 2.7% + fixed fee per transaction in the US |

| International transactions | An additional 1.5% for cards issued outside of the US | 1.5% cross-border fee + 2.9% transaction fee + fixed fee |

| Currency conversion | 2% if using a currency other than your Shopify account’s default | Up to 4% above the exchange rate |

| Chargebacks (we’ll discuss this later) | $15 (if the customer’s bank resolves the dispute in your favor, the fee is refunded) | $20 per chargeback |

📢 Shop Pay wins

Putting all costs into account, it’s clear that Shop Pay is a more budget-friendly payment option, especially if you process international transactions frequently.

3.2. Ease of use

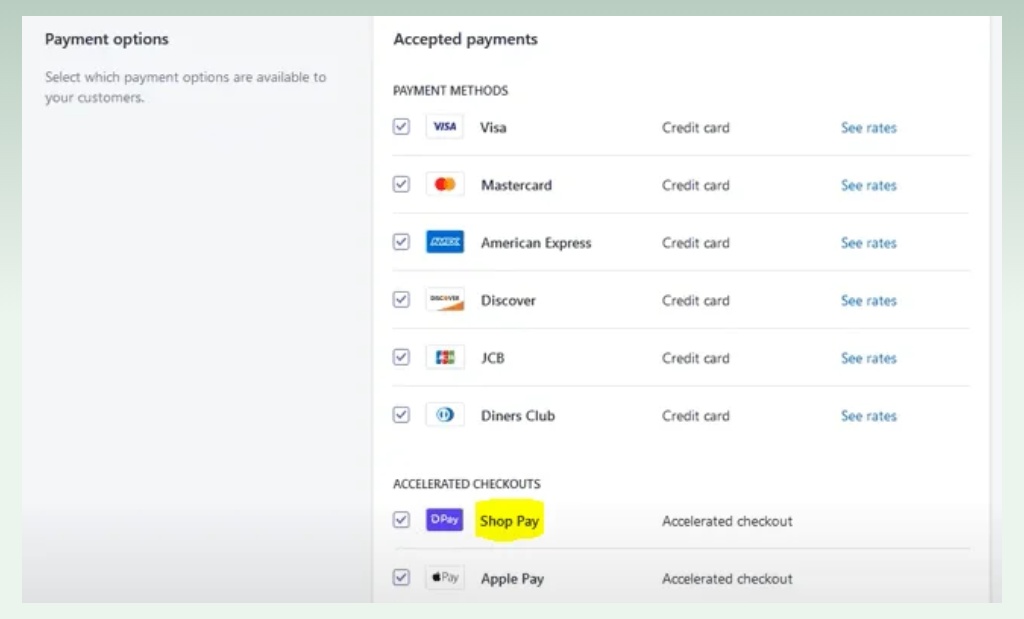

Shop Pay is super easy to enable. All you have to do is navigate to your Shopify Payments settings and tick the Shop Pay option on the ‘Accelerated Checkouts’ section. Afterward, click Save, and you’re done.

Meanwhile, activating PayPal may take a bit more time as you’ll need to sign up for a PayPal account and install the payment gateway to your store. However, don’t take us wrong. It’s still easy peasy to set up PayPal, just not as effortless as Shop Pay.

📢 Shop Pay slightly wins

Both Shop Pay vs PayPal are easy to set up, but with Shop Pay, a few clicks are all it takes.

3.3. Countries supported

Shop Pay can only be activated with Shopify Payments. And unfortunately, Shopify Payments is available in these 23 countries only:

| 1. Australia 2. Austria 3. Belgium 4. Canada 5. Czechia 6. Denmark 7. Finland 8. France 9. Germany 10. Hong Kong SAR | 11. Ireland 12. Italy 13. Japan 14. Netherlands 15. New Zealand 16. Portugal 17. Romania 18. Singapore 19. Spain 20. Sweden | 21. Switzerland 22. United Kingdom 23. United States |

PayPal is available in over 200 countries– almost 10x the number of Shop Pay. Hence, we’re not going to list them all. Instead, here’s a list of countries PayPal doesn’t support. If you’re not based in one of these countries, you can enable PayPal on your Shopify store:

| 1. Afghanistan 2. Bangladesh 3. Cameroon 4. Central African Republic 5. Cote D’Ivoire (Ivory Coast) 6. Democratic People’s Republic of Korea (North Korea) 7. Equatorial Guinea 8. Gabon 9. Ghana 10. Haiti | 11. Iran 12. Iraq 13. Lebanon 14. Liberia 15. Libya 16. Monaco 17. Moldova 18. Montenegro 19. Myanmar 20. Pakistan | 21. Paraguay 22. Saint Lucia 23. South Sudan 24. Sudan 25. Syria 26. Timor-Leste 27. Uzbekistan 28. Zimbabwe |

📢 PayPal wins convincingly

Shop Pay only supports over 20 countries, which is far, far behind the number that PayPal offers– 200 countries.

3.4. Currency

When it comes to handling different currencies, Shop Pay supports 13, including AUD, EUR, CAD, USD, CZK, DKK, HKD, JPY, NZD, SGD, SEK, CHF, and GBP.

On the other hand, PayPal supports a broader range of 25 currencies: AUD, BRL, CAD, CNY, CZK, DKK, EUR, HKD, HUF, ILS, JPY, MYR, MXN, NOK, NZD, PHP, PLN, GBP, RUB, SDG, SEK, CHF, TWD, THB, and USD.

📢 PayPal wins convincingly

Compared to Shop Pay, PayPal allows you to support 25 popular currencies– double the number of Shop Pay.

3.5. Payout schedule

With Shop Pay, the process of transferring money to a merchant’s bank account typically takes about three business days. This swift transfer is particularly beneficial if you rely on a steady cash flow to quickly reinvest in stock, marketing, or other operational needs.

In contrast, PayPal’s transfer process is slower, with funds typically taking 5-7 business days to be credited to a merchant’s bank account.

📢 Shop Pay wins

Shop Pay clearly offers a more advantageous solution for merchants, giving it an edge over PayPal in this aspect.

3.6. Dispute resolution

When navigating disputes and chargebacks, both Shop Pay and PayPal have their specific rules and fees you should be aware of.

With Shop Pay, after a transaction is completed, the review process for a dispute typically takes between 65 to 75 days, but it may extend further. It’s crucial for you to be aware of Shop Pay’s chargeback policy, as you will be charged a $15 fee for each chargeback.

Moreover, if you encounter frequent disputes, Shop Pay might lock your store and funds indefinitely, which could significantly impact your business operations.

In comparison, PayPal applies strict protocols for fraud prevention and dispute resolution. If a claim or dispute is filed against you, PayPal may freeze the funds in question. You have 10 days to respond to the claim by providing the necessary evidence to support your case.

The resolution process with PayPal can also take up to 75 days. PayPal imposes a $20 chargeback fee, which is slightly higher than that of Shop Pay.

Additionally, if disputes recur, PayPal may permanently lock your account, similar to the repercussions you might face with Shop Pay in the event of repeated disputes.

📢 Shop Pay slightly wins

Both Shop Pay and PayPal can take up to 75 days to resolve disputes. However, the chargeback fee of Shop Pay is lower than PayPal, allowing you to reduce your costs for unwanted chargebacks.

3.7. Support

Shopify is known for its outstanding support for merchants, especially when it comes to issues related to Shop Pay. You can get immediate access to support from Shopify staff via 24/7 live chat.

In addition to that, Shopify also offers you support through various other channels like email, social media, etc.

In comparison, PayPal also offers great support. However, it doesn’t match the immediacy and accessibility of Shopify’s support network. While PayPal provides the option to message their support team, responses can take a few hours. This means that urgent issues may not be resolved as quickly as you might prefer.

📢 Shop Pay wins

Overall, both Shopify and PayPal provide merchant support. However, Shopify’s approach is particularly notable for its round-the-clock live chat service and a wider array of support options.

3.8. Security

Shop Pay ensures that your customers’ credit and debit card information is kept secure by storing it in an encrypted format on servers that comply with PCI standards.

Additionally, Shop Pay includes an SMS verification feature, which provides an extra layer of security. This verification process confirms that the person making the transaction is indeed the card’s rightful owner.

Similarly, PayPal adheres to the PCI DSS, ensuring that all customer card information is encrypted and stored on protected servers.

📢 It is a tie.

Shop Pay vs PayPal are both highly secured payment options with strict adherence to PCI standards.

4. Shop Pay vs PayPal credit card: Which one to choose?

Now that we’ve walked you through all the key factors of Shop Pay vs PayPal, let’s now wrap things up!

|  | |

| Suitable for | Shopify merchants who are eligible for Shopify Payments. | Whether you are eligible for Shopify Payments or not, PayPal is highly recommended due to its popularity. |

| Pros | ✅ Super easy to activate and set up Shop Pay speeds up the checkout process, leading to higher conversion ✅ Shop Pay offers BNPL (Buy now, Pay later) option and Shop Cash for eligible US stores | ✅ PayPal is one of the most payment service providers worldwide ✅ User base of PayPal is much larger than Shop Pay ✅ PayPal supports over 200 countries and 25 currencies. |

| Cons | ❌ Only merchants who are eligible for Shopify Merchants can enable Shop Pay. ❌ Smaller user base compared to PayPal ❌ Shop Pay is only available in 23 countries and supports 13 currencies. | ❌ PayPal has expensive chargebacks ❌ PayPal might unpredictably freeze your accounts for suspicious activity ❌ PayPal’s transaction fees vary significantly by country and purpose |

Choose Shop Pay if you are valid for Shopify Payments. Well, Shop Pay doesn’t charge you any extra fee, and it helps speed up your customers’ checkout process, improving your conversions. So, the question here isn’t ‘Why’, it’s ‘Why not?’

Choose PayPal if a large number of your target audience is using PayPal to process online payments.(*)

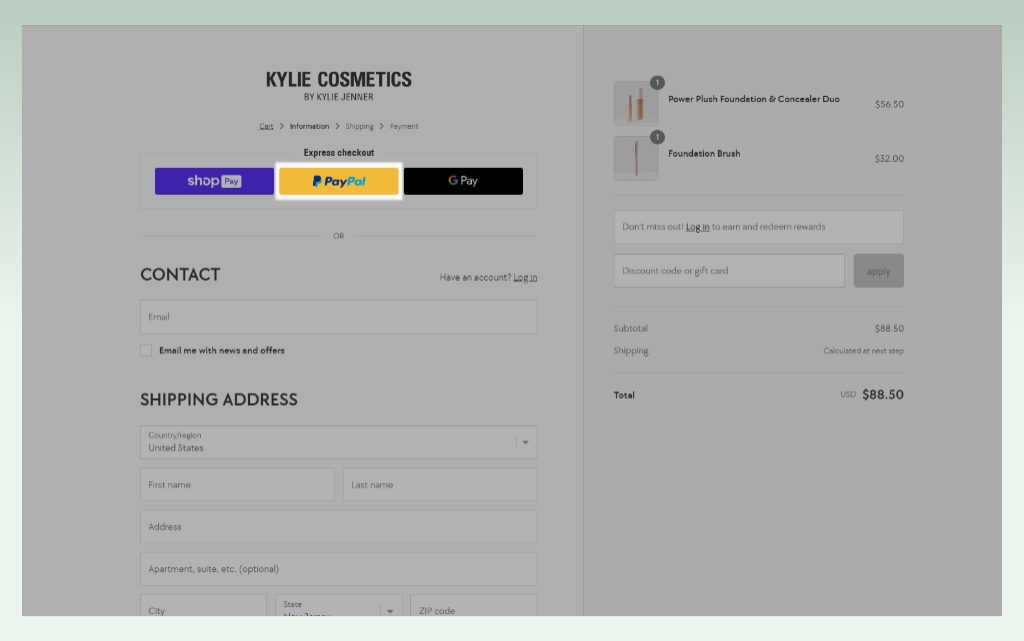

Our advice? Activate both Shop Pay and PayPal on your Shopify store – which we’ll discuss right next!

(*) Note: As we mentioned, PayPal has varied transaction fees depending on your customers’ cards and locations. Therefore, if you are considering activating PayPal, get to know all the possible fees first.

5. Can you use Shop Pay and PayPal together?

Yes, you could and should use Shop Pay and PayPal together to give your customers more payment options, improving your checkout page conversions.

5.1. Why use Shop Pay and PayPal together?

If you are eligible for Shop Pay, we highly recommend you enable both Shop Pay and PayPal on your e-shop so you can:

- Give your customers more choices

By offering both Shop Pay and PayPal, you can cater to a wider range of customer preferences. Some customers might prioritize the speed and convenience of Shop Pay, while others might prefer the familiarity and buyer protection associated with PayPal.

- Enhance your security and backup

Offering multiple payment methods linked can be helpful if your preferred method run into temporary problems. For instance, if your customers cannot check out with Shop Pay, they can continue the checkout process with PayPal and vice versa.

5.2. How to set up Shop Pay and PayPal?

Following our instructions below to activate Shop Pay and PayPal for your Shopify store:

To set up Shop Pay:

- Within your admin dashboard, go to Settings > Payments.

- Navigate to the Shopify Payments section, and click Manage.

- In the Accelerated Checkouts sections, tick Shop Pay.

- Click Save.

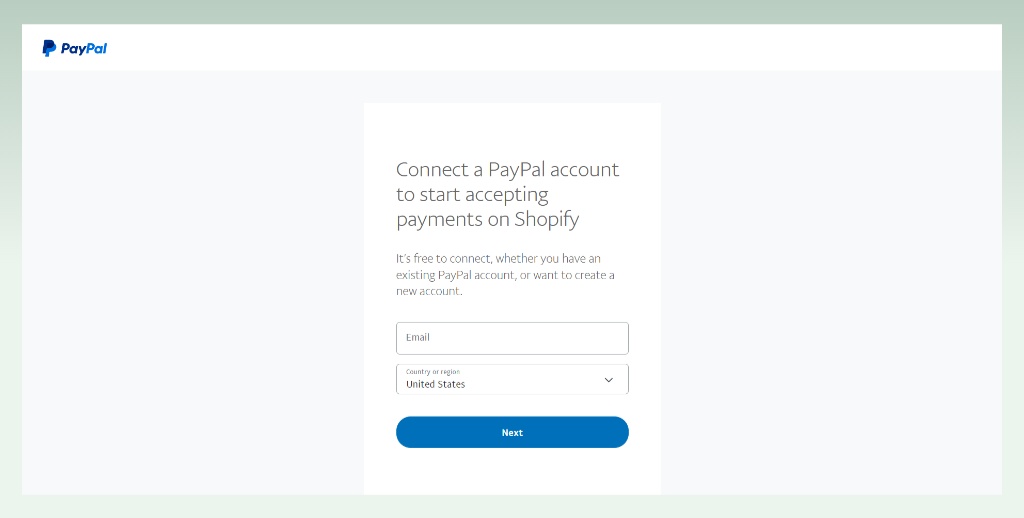

To set up PayPal:

- Within your admin dashboard, go to Settings > Payments.

- Go to the Additional payment methods section, and select ‘Setup incomplete’ next to PayPal.

- Hit Complete setup.

- Input your PayPal account’s email address, then click Next.

- Type in your PayPal account’s password, and then click Next.

- Enter your business details on the Tell us about your business page

- Review the terms and conditions, then click Agree and Create Account.

- When you’re on the Describe your business page, follow these steps:

- Pick your business type from the drop-down menu.

- Input your business details.

- Hit Next.

- Enter your details on the Tell us more about you page, then click Submit.

- Click Go back to Shopify on the confirmation page,

| 🤔 Can your customers use Shop Pay and PayPal simultaneously for a single transaction? No, they cannot. Shop Pay and PayPal are distinct payment processors. During a single checkout, you can only process transactions through one payment processor at a time. |

6. Conclusion

All in all, Shop Pay and PayPal are both popular payment options. eComStart hopes after reading our Shop Pay vs PayPal comparison, you can figure out which payment option you should enable for your Shopify store.

Don’t forget to check out eComStart.io for insightful blog posts on eCommerce.